Article by Carmeli Argana and Paul-Alain Hunt

Lynas Rare Earths Ltd., backed by Australia’s richest person Gina Rinehart, has been the most resilient stock on the country’s index since the market turmoil started last week.

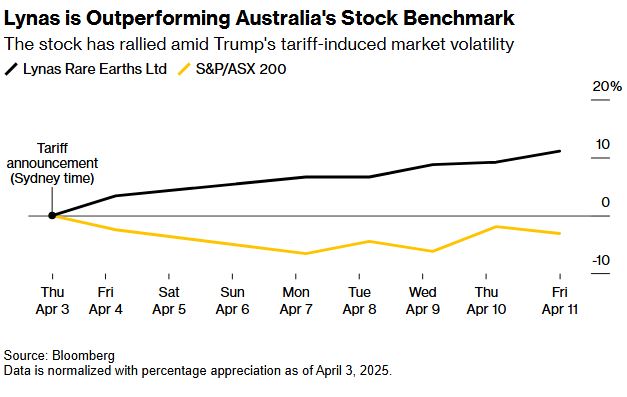

Since US President Donald Trump launched the so-called reciprocal tariffs, the Australian miner has been the only stock on the benchmark S&P/ASX 200 Index to avoid decline. After the announcement it rallied every day except for Tuesday, when it remained flat.

With a major processing plant in Malaysia, the company “stands out because the majority of rare earth operations globally are either in China, or send their concentrate to China for processing,” said Justin Lin, an investment analyst at Global X ETFs in Sydney. “Lynas entirely circumnavigates that process.”

Iron ore mining magnate Rinehart holds a 8.2% stake in Lynas through her privately held company, according to Bloomberg data.

The Australian miner is one of the numerous rare earths explorers in the Asia Pacific region that have gained from the escalating trade conflict between the US and China. The top producer’s export restrictions on the minerals, a retaliatory measure against the US, spurred a buying rush.

The minerals are essential to a wide range of technologies, including ammunition, wind turbines, electric mobility, nuclear reactors, and lithium-ion batteries. Countries including Korea and Japan, which rely on the elements for semiconductors and EV production, may fast track their orders, according to Lin.

Miners are doing well in the short term because “there’s widespread awareness that rare earths are an economic weapon that China is willing to use in its trade war against the US” and that the current curbs could escalate to a full ban, Lin said.

Amid concerns over future supplies, Chinese rare earths miners China Rare Earth Resources And Technology Co. and China Northern Rare Earth Group rallied this week.

US levies on China currently sit at 145% after tit-for-tat announcements throughout the week, despite a 90-day halt on all other tariffs. That brings tariffs to their highest level in more than a century. Last week, Beijing added seven out of the 17 recognized types of rare earths to its export control list.

Lynas is set to expand its plant in Malaysia to include some of the elements in the list by June, which will make it the only facility of its kind outside China, according to the company.