Article by Josh Chiat courtesy of Stockhead.

Gina Rinehart’s $60 million move on Arafura Rare Earths (ASX:ARU), which will see her join a $121m institutional placement to own around 10% of the emerging critical minerals stock, is the latest sign it is becoming the place to be.

Arafura owns the Nolans project, one of the largest rare earths deposits prepped for development.

In its pomp it will produce 4440t of neodymium-praseodymium oxide over a long-term 38 year mine life.

The company expects at least nine more Nolans would be needed to fill a supply gap of 45,000t by 2030 as electric vehicle and wind turbine rollouts accelerate.

According to a presentation by the Gavin Lockyer-led firm, those applications will chew up 55% of the NdFeB magnet market by 2035.

The race is on and the billionaires are desperate for a slice.

Gina’s move on Arafura follows her reported investment in pre-IPO clay rare earths play Brazilian Rare Earths.

Her interest in rare earths could be read in the context of an energy-led investment thesis from the iron ore magnate, whose private company made her and her family members $5.8b in profit last year. According to is latest annual report, Hancock’s investment portfolio in future metals, established in FY21, has made an overall gain of $645m over the past two years.

Its major listed lithium, copper and rare earths investments also include a stake in geothermal lithium explorer Vulcan Energy (ASX:VUL).

She has also bet big on gas, with Hancock Energy recently trumping Kerry Stokes-backed Beach Energy (ASX:BPT) in a still-live bidding war for Perth Basin explorer Warrego Energy (ASX:WGO).

Not the only one

Gina is not the only iron ore billionaire taking a keen interest in rare earths.

Mineral Resources (ASX:MIN) boss Chris Ellison, whose early bet on the future of lithium has made the ASX 50 listed miner a motsa, is a big shareholder in Vic mineral sands and rare earths IPO hopeful VHM.

Andrew Forrest’s Wyloo Metals made a $150 million investment into WA’s Hastings Technology Metals (ASX:HAS) in the form of convertible notes to bankroll its investment in a North American magnet producer, Neo.

And his listed iron ore giant, $60 billion Fortescue Metals Group (ASX:FMG) has highlighted rare earths as a major target in plans to diversify its iron ore mining business.

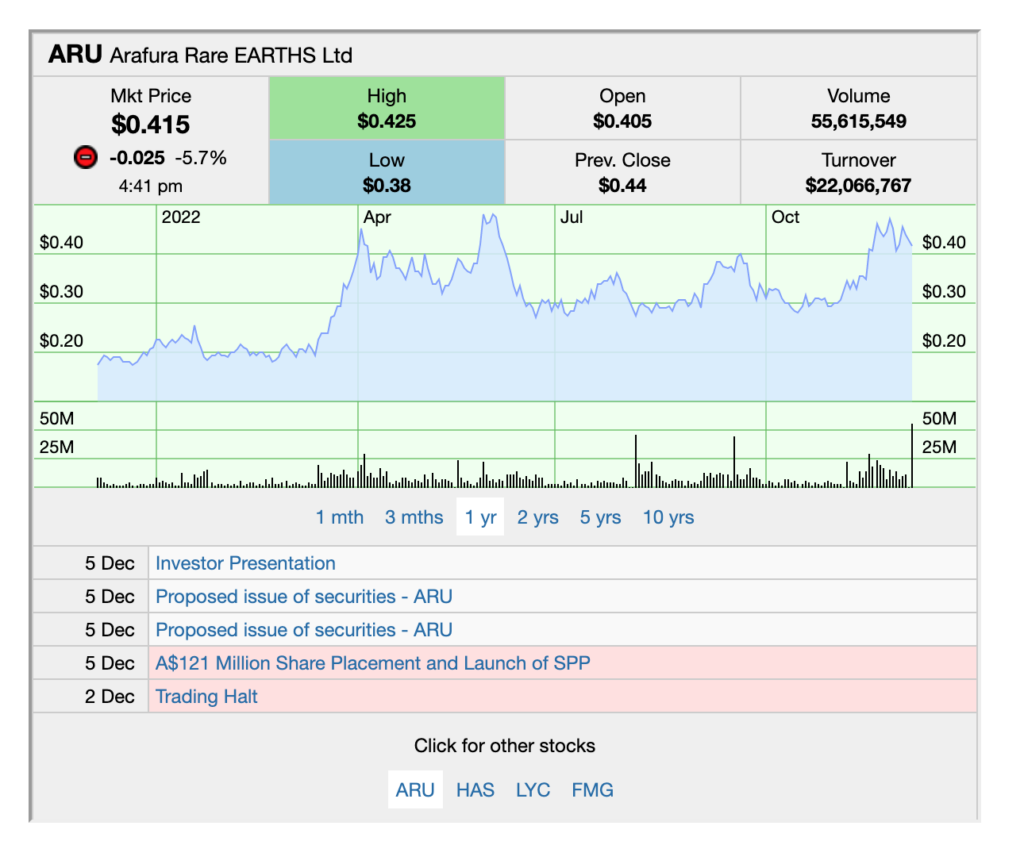

Rare earths share prices today: