Article by Mark Beyer, courtesy by Business News.

Western Australia’s resources sector has been characterised this year by mine closures and projects shutdown, across the nickel, lithium, alumina and iron ore sectors.

What has garnered less attention has been the almost complete lack of major new projects.

The only substantial new project to be sanctioned this year is BHP’s $1.4 billion Western Ridge Crusher mine and, by the standards of WA’s resources sector, that is not a very large development.

These two trends – mine closures and a lack of new projects – cast a pall over employment and contracting opportunities in the sector.

If sustained, they also put a question mark over the state’s economic prospects.

Its not just the mining sector with a lack of new investment.

Business News reported in August that, despite all the talk about the transition to renewables, there are no major wind farms or solar farms under construction in the South West.

To put this in context, there is still a large amount of investment proceeding in mining, petroleum and associated infrastructure projects that have been sanctioned in previous years.

Some $55 billion in projects were either committed or under construction at March this year, according to the Department of Energy, Mines, Industry Regulation and Safety.

A lot has changed since then.

- Mineral Resources has completed construction of its $3 billion Onslow Iron project, with the final touches being put on the dedicated haul road this month.

- BHP has halted development work at its $1.7 billion West Musgrave nickel-copper project, as well as shutting down its entire Nickel West operation, with the loss of more than 3,000 jobs.

- Liontown Resources has finished construction of its $950 million Kathleen Valley lithium mine.

- Mitsui & Co and Beach Energy have completed their $750 million Waitsia Stage 2 gas project, which is now being commissioned.

- Albemarle Corporation has scaled back the development of its Kemerton lithium refinery.

Albemarle had been planning to invest more than $2 billion building four lithium hydroxide processing trains but has put train 2 on care and maintenance and halted construction of trains 3 and 4 while it focuses on ramping up production from train 1.

The cutbacks have come at the cost of about 450 jobs and led contractors Monadelphous and UGL to wipe about $300 million off their order books.

It’s a similar story at Tianqi’s Kwinana lithium refinery.

Two-and-a-half years after announcing first production of battery-grade lithium hydroxide, Tianqi is still battling to achieve nameplate capacity on train 1 and is yet to approve the go-ahead on its long-planned train 2.

Wesfarmers’ half-owned Covalent Lithium will be hoping for better results when it starts commissioning its $2.5 billion Kwinana refinery later this year or early next year.

The cutbacks listed above are not the end of the story.

- Five nickel miners, including IGO and Wyloo Metals, have halted (or plan to halt) production at their WA mines.

- Mineral Resources is stopping iron ore production at its Yilgarn operation.

- Alcoa is mothballing its Kwinana alumina refinery.

- South32 has claimed that new environmental conditions threaten the commercial viability of its Worsley Alumina operation.

Collectively, the cutbacks in WA’s mining industry this year have led to at least 9,000 job losses.

Of the resources projects in WA, well over half the total investment ($28.5 billion) is in the oil and gas sector.

Much of that is on offshore projects like Woodside’s Scarborough, Shell’s Crux and Chevron’s Jansz-Io, which have limited flow-on to local jobs and contractors.

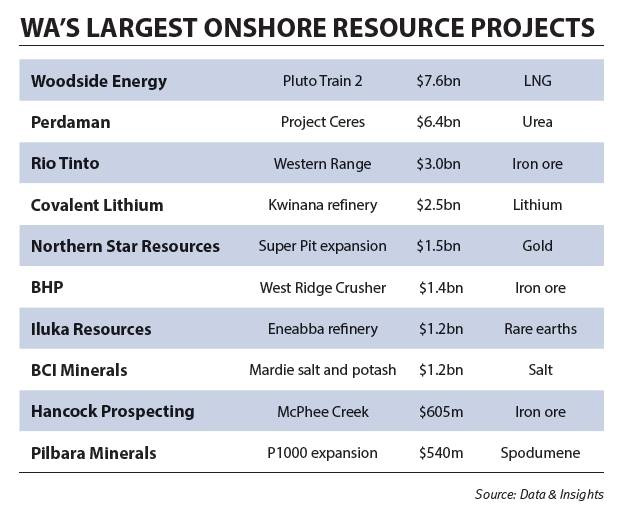

The major onshore projects that are still under way are led by Woodside’s Pluto Train 2 development and Perdaman’s Project Ceres urea development (see table, page 10).

In the mining sector, the big projects include Rio Tinto’s Western Range iron ore mine in the Pilbara and Northern Star Resources’ Super Pit expansion at Kalgoorlie.

Future projects

The big question for WA is how many new developments proceed to make up for the job losses and to fill the order books of contractors, once they complete their work on existing projects.

DEMIRS has estimated there is $120 billion worth of possible and planned resources projects in WA.

This encompasses projects that are undergoing scoping, pre-feasibility or definitive feasibility studies.

It includes many projects that can best be described as aspirational.

For instance, iron ore projects like Cashmere Downs, Yogi and Mount Ida have been on the ‘possible’ list for a decade or more and appear no closer to development.

Other projects are being pursued by very small companies.

Surefire Resources, for instance, has a market value on the ASX of $15 million yet is pursuing development of the Victory Bore vanadium project, with a capital cost of $767 million.

That is challenging, to say the least.

Even the state’s biggest miners are challenged, as they navigate volatile commodity prices and a long and complex approvals process that often includes federal, state and local governments and traditional owners.

Hancock Prospecting, for instance, took three-and-a-half years to gain the final environmental approval from the federal government for its McPhee Creek iron ore mine in the Pilbara.

Hancock’s chief executive of group projects, Sanjiv Manchanda, said the project had a very small footprint, with annual production of a modest 10 million tonnes, and would use existing processing, rail and port infrastructure.

“Yet (it) was referred for a long approval process in early 2021 and has experienced a multitude of challenges from changes to heritage legislation, and changes to federal environment guidelines,” he said.

Mr Manchanda said last month he was pleased to achieve this milestone after long and sustained dialogues at all levels.

Another mining giant battling to gain project approvals is Rio Tinto.

It has been working for several years to gain approvals for its next tranche of iron ore mines, which it needs to reach its medium-term production target of 345 million tonnes.

Rio is aiming to bring West Angelas, Hope Downs 1, Greater Nammuldi and Brockman 4 into production between 2026 and 2028.

That will follow its Western Range mine, which is 70 per cent complete and due to start production in 2025.

Rio is guarded on the timing for its upcoming projects, saying they remain subject to timing of approvals and heritage clearances.

It has acknowledged the Greater Nammuldi project is “starting to diverge from the original development schedule”.

Asked about the schedule on a recent investor call, chief financial officer Peter Cunningham was not specific.

He said the approvals process for the four new mines remained “pretty much absolutely” in line with the group’s plans.

“At the moment broadly that plan remains on track,” he said.

Despite not having final approvals, Rio started early works at Hope Downs 1 during the June quarter.

It has also awarded a contract to NRW Holdings for early works at West Angelas.

NRW said up to 120 people would be employed on the Rio contract, which included an upgrade to the existing single-lane maintenance access road to a dual-lane haul road.

Rio iron ore chief executive Simon Trott said last year the average time for environmental approvals for major mining projects in WA had increased by 12 to 18 months over the past five years.

It now averaged about four years; double what it was in 2003.

Mr Trott said this was an example of a global trend, with a greater focus on environmental, social and governance issues.

“Across every global jurisdiction where we operate, the expectations of regulators, traditional owners and civil society have increased,” he said.

Against this backdrop, it is no surprise Rio has already done the work preparing for development of its giant Rhodes Ridge mine.

Rio is targeting first ore from Rhodes Ridge by the end of this decade, yet it has already completed an ‘order of magnitude’ study and in December last year approved spending of $110 million on a pre-feasibility study.

That will be followed by a full feasibility study.

It may be early days, but Mr Trott has signalled annual production at Rhodes Ridge could reach 100 million tonnes, making it the largest mining operation in the Pilbara.

“The size and quality of the resource base at Rhodes Ridge has the potential to underpin our iron ore business in the Pilbara for decades to come,” he said.

BHP growth

BHP is at a different stage in its growth cycle.

Its $4.6 billion South Flank project is running at capacity and its Western Ridge Crusher project is due to come online in 2026.

Western Ridge will deliver 25mtpa to sustain volumes at BHP’s Newman operations.

BHP’s plan is to ‘creep’ production to 305mtpa over several years through debottlenecking and productivity gains.

That is up from guidance of 282mtpa to 294mtpa in FY25.

It also has studies under way exploring options to lift production to 330mtpa but with a soft outlook for iron ore, chief executive Mike Henry has not made any commitments.

“That second tranche is not locked in,” Mr Henry told a media call last month.

He explained that BHP would take this option “if market circumstances warrant and if the underlying economics are attractive relative to other options”.

“That is still a couple of years off,” he said.

In the same media call, he made it clear BHP’s focus was on other commodities, notably copper and potash.

Jobs challenge

Chamber of Minerals and Energy WA chief executive Rebecca Tomkinson said employment in the state’s resources sector had shrunk by around 20,000 jobs in the past year.

She sees multiple challenges.

“Australian projects are facing headwinds, including international market distortions, commodity market fluctuations and escalating input costs,” Ms Tomkinson said.

“At the same time, the regulatory and policy environment has become far more uncertain.

“Concerningly, this is impacting business sentiment and our attractiveness as an investment destination.”

Ms Tomkinson said the industry supported strong environmental and heritage protections.

“Indeed, WA’s robust environmental, social and governance performance is essential to attract the investment needed to develop new projects and expand existing ones,” she said.

“But equally critical is the need for timely and efficient environmental assessments.”

Like others in the sector, she expressed particular concern over federal approvals.

“Lingering uncertainty over Nature Positive legislation and significant delays experienced by assessments conducted under the current federal environmental regulatory regime is casting doubt over the viability of new projects,” she said.

“There needs to be strong accountability within government to deliver to timeframes.”

Ms Tomkinson said CME members had also reported an increase in union activity since the federal government’s industrial relations changes came into effect.

A further challenge was the lack of investment in energy infrastructure.

“As the CME has now repeatedly called for, there needs to be a rapid acceleration of the planning and delivery of new transmission lines in both the SWIS (South West Interconnected System) and NWIS (North West Interconnected System), which is critical to unlocking investment in large-scale renewables,” she said.

One big miner taking a lead on this front is Gold Fields.

In March, it approved a $296 million renewables project at its St Ives mine, including a 42-megawatt wind farm and a 35-megawatt solar farm.

Hancock Prospecting executive chairman Gina Rinehart has stated that mining investment will continue to move offshore “if we keep bringing in policies and adding government tape that keep attacking the mining golden geese”.

That said, her company is continuing to pursue multiple projects in WA. The timing on all of them has drifted.

They include Mulga Downs, which is targeted to produce 12mtpa of iron ore (down from initial plans for 20mtpa) and the Ridley magnetite project.

Mr Manchanda told Business News in July 2023 Mulga Downs and Ridley were proceeding concurrently.

“Ridley is progressing in parallel with a similar intensity to get to a final investment decision towards the end of the year or early next year,” he said.

That timeline has well and truly passed.

Hancock is also working on development of the Mulga Downs hub, which will receive up to 40mt of ore per year from multiple mines.

The ore will be transported on a new 70-kilometre rail spur to an existing rail line to Port Hedland.

At the port, the group has won the rights to develop a new shipping berth in joint venture with Mineral Resources.

It was three years ago that the two groups signed an agreement to pursue this opportunity and more than two-and-a-half years ago that their joint venture was awarded a new capacity allocation.

In February 2022, MinRes said approvals for the project were expected to be finalised by the middle of that year.

MinRes told Business News this process was still under way.

“MinRes is progressing the relevant approvals for the South West Creek project alongside finalising agreements with our partners before a positive investment decision can be taken,” a spokesperson said.

In the meantime, MinRes is focused on the ramp-up of its Onslow Iron project.

One more project on Hancock’s radar is the Mt Bevan magnetite development, jointly owned by ASX-listed explorers Legacy Iron Ore and Hawthorn Resources.

A pre-feasibility study completed this year put a $5 billion price tag on the project, which would produce 12mtpa of magnetite concentrate over 25 years.

The joint venture recently committed to spend $20 million on further project evaluation over the next two years, signalling this project is some time away.

Gold and more

Beyond the iron ore sector, the Pilbara is set for a boost from two big gold projects.

ASX company De Grey Mining has been preparing methodically for a final investment decision on its Hemi mine, budgeted to cost $1.35 billion.

De Grey is awaiting final environmental approvals but has already started ordering major pieces of equipment, signalling the company’s confidence in a positive outcome.

It is likely to be followed by Greatland Gold, which is aiming to develop the Havieron gold mine at a cost of some $500 million.

That project is tied to Greatland’s plan to buy the nearby Telfer mine, which is close to exhausting its orebody but has a processing plant that can be fed by Havieron ore.

The timing of this project is unclear.

Northern WA has also been earmarked by two large salt projects.

Germany’s K+S Group has spent more than $10 million preparing for development of its Ashburton Salt project.

When the project concept was unveiled in 2016, the company said it expected the project to cost $350 million and the approvals process to take three years.

Eight years later, the company is still going through the environmental approval process while also battling opposition from activist group Protect Ningaloo.

The cost has also increased dramatically, to $850 million.

Subiaco-based Leichhardt Industrials Group is working on the Eramurra Solar Salt project, near Karratha.

Leichhardt is aiming for a final investment decision in 2025, pending government approvals, ahead of first production in 2028.

Other companies progressing big projects include Arafura Rare Earths, with its $1.6 billion Nolans project, and Hastings Technology Metals with its Yangibana project.

Australian Vandium is another Perth-based ASX company making slow but steady progress on an ambitious project.

The big X factor for WA’s resources sector is the lithium market.

The collapse in lithium prices over the past year has triggered multiple cutbacks across the sector.

The volatility in lithium prices means that could easily turn around and spark renewed investment.

This could include Albemarle and Tianqi reinvesting in their lithium refinery expansions.

If that happens, Talison Lithium (which is majority owned by Albemarle and Tianqi) could press go on its planned CGP4 expansion at its Greenbushes mine, which feeds spodumene concentrate to the refineries.

Contractors

For contractors servicing the resources sector, engineering and construction contracts are a critical driver of their business.

NRW, for instance, recently won a works package for the expansion of Lynas Rare Earths’ Mt Weld mine.

Its major ongoing work includes engineering and construction at Northern Star Resources’ Super Pit expansion in Kalgoorlie.

NRW subsidiary Primero Group is responsible for the design, procurement, construction and commissioning of the process plant.

Primero won the $973 million contract last year.

Similarly, CIMIC Group subsidiaries Sedgman and CPB Contractors recently secured a $757 million contract with BHP.

The two subsidiaries will undertake extensive design and construction work at the Western Ridge Crusher project.

Perdaman’s Project Ceres has also started to deliver work to local contractors.

Monadelphous recently won construction and heavy haulage contracts at the urea project.

It also picked up a $200 million contract to deliver modifications at Woodside’s Pluto LNG plant.

The good news for contractors facing an uncertain project flow is the huge volume of ‘sustaining’ capex on existing mines and gas plants.

For instance, of the $3 billion in new contracts and contract extensions won by Monadelphous during FY24, nearly two thirds were maintenance and services contracts with the likes of Woodside, Inpex and Shell.

It also delivered maintenance work for iron ore giants Fortescue, BHP and Rio Tinto.

Collectively, the big iron ore miners in the Pilbara spend an estimated $7 billion to $8 billion each year on sustaining capex.