Article by Chris Herde & Glen Norris courtesy of the Weekly Times.

Revenue for Australia’s largest 500 unlisted businesses defied economic challenges to growth by one fifth in the last financial year.

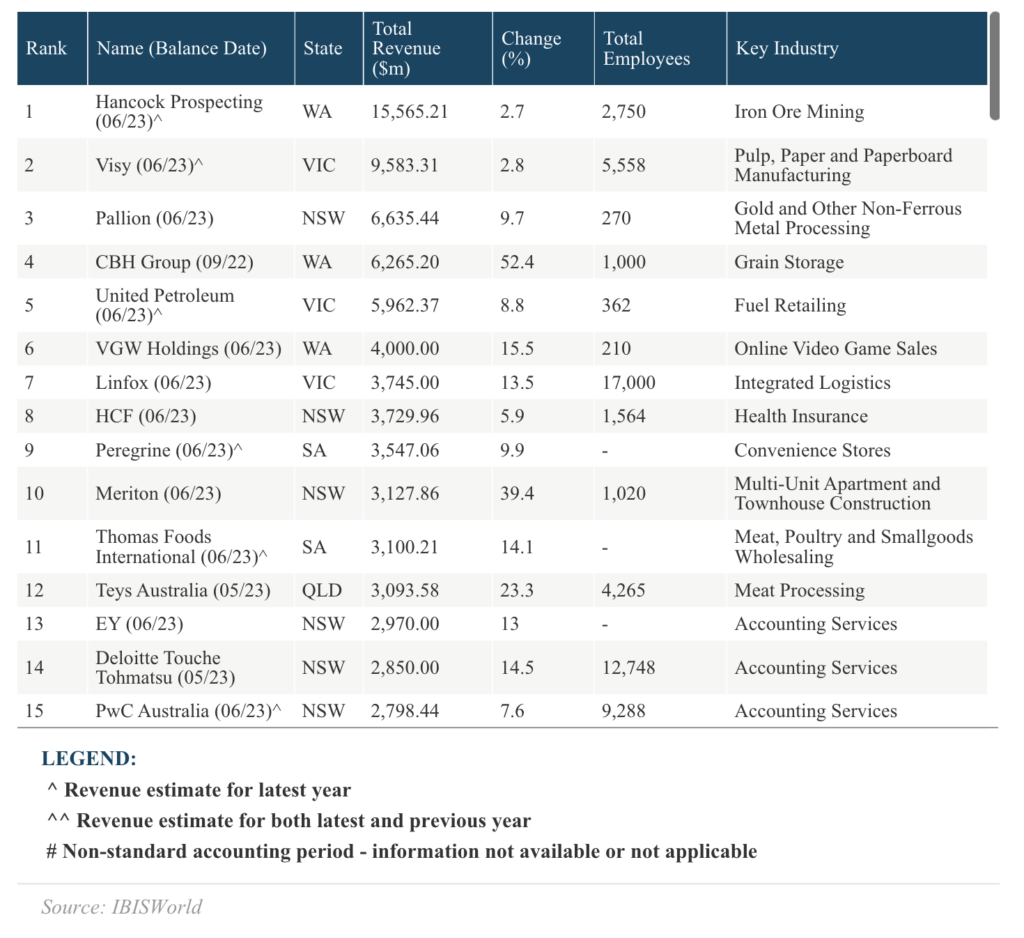

Gina Rinehart’s Hancock Prospecting has retained its crown as Australia’s largest private company, as revenue for unlisted businesses surged over the past financial year.

IBISWorld’s Top 500 list of private companies found total revenue for Australia’s largest 500 unlisted businesses defied economic challenges to grow by one- fifth in the past financial year.

It estimated total revenue for private companies, partnerships, co-operatives, associations and non-listed public companies hit $332.9bn in 2022-23, an increase of 20.3 per cent from the previous 12 month aggregate of $276.7bn.

Average revenue for a top 500 company in the IBIS list jumped to $665.9m in the past financial year, up from $553.4m in 2021-22.

Hancock Prospecting held its position as Australia’s best-performing private enterprise with an estimated revenue of $15.6bn in the 2023 financial year, a 2.7 per cent rise on the previous 12 months.

It was followed by the Pratt family’s pulp, paper and paperboard manufacturing business Visy, with estimated revenue of $9.6bn, up 2.8 per cent.

Hancock Prospecting boosted its revenue by expanding its market share in iron ore mining, and continued to invest in petroleum exploration, metals, minerals and cattle farming.

Executive chairman Gina Rinehart, Australia’s richest person, said the company had earned its position through “extremely hard work”.

“If we want to continue this success, then we need to remain vigilant and not let our success diminish our efforts,” she said.

“Our investments are not driven by hype or by seeking taxpayers’ monies from governments. We know the law of supply and demand. It is fundamental – if supply falls, prices will rise.

“We continue to seek out tier-one assets, and would prefer to have the vast majority of our investment in Australia. Investment in Australia is what enables our high living standards; however, we must be mindful of government policies that make investment and development unattractive.”

WA grain storage company CBH – which is owned by about 3500 WA grain-growing businesses – came in fourth. United Petroleum, founded by Avi Silver and Eddie Hirsch, was next, with Laurence Escalante’s online social gaming business VGW Holdings, also from WA, in sixth place.

The Lindsay Fox-founded transport and logistics giant Linfox dropped from fifth place to seventh, despite a 13.5 per cent jump in estimated revenue to $3.7bn, stemming from a partnership with not-for-profit Transport Women Australia Limited and investment in new technologies.

Health insurer HCF and Adelaide’s billionaire Shahin brothers’ Peregrine Corporation, which owns the On The Run service station chain, were eighth and ninth.

Apartment king Harry Triguboff Meriton’s revenue rose almost 40 per cent and jumped to 10th place, up from 21st last year. Queensland’s top company was meat processor Teys Australia – a joint venture between the Teys family and the Cargill Company – which rose to 12th from 16th with a 23 per cent revenue boost, passing Hutchinson Builders, which slipped from 10th to 18th, although revenue rise 3.5 per cent.

The survey found that 81 per cent of companies on the 2021-22 list advanced their overall revenue. The biggest mover was Brisbane-based Firstmac, a company involved in the non-depository financing industry, which rose from 449th spot to 81st place.

AMP head of investment strategy and economics Shane Oliver said there were pros and cons for companies in not being publicly listed. “Private companies to have the advantage that they have that flexibility which comes from not having shareholders to answer to,” he said.

“I suppose on the other side many are owned by families and business partners and there have been instances there was conflict, especially when the founders get older and there needs to be a succession plan.”

Construction was the best performing industry in the list with heavyweight Meriton, Vaughan Constructions, Mainbrace Constructions and Fairbrother all improving their performance. Revenue growth across the four averaged nearly 50 per cent as they benefited from infrastructure development.

However, the poorest performing industries included the housing construction sector, which has floundered as a result of rising interest rates.

There were 25 appearances from the motor vehicle dealership industry, with the boom attributable to purchases delayed by the pandemic and the easing of supply chain disruptions.

The private general hospital industry was also well represented, with Mater Misericordiae Limited boosting its revenue performance through the acquisition of HealthCo’s Springfield Health Hub.

IBISWorld bases its revenue estimates on company revenue data, employee figures and industry figures.