Article by Claire Tyrrell courtesy of Business News.

Moves by mining magnate Gina Rinehart to expand her company’s presence in West Perth reflect broader sentiment in the area.

If recent plays by mining magnate Gina Rinehart are anything to go by, the West Perth office market is on its way back.

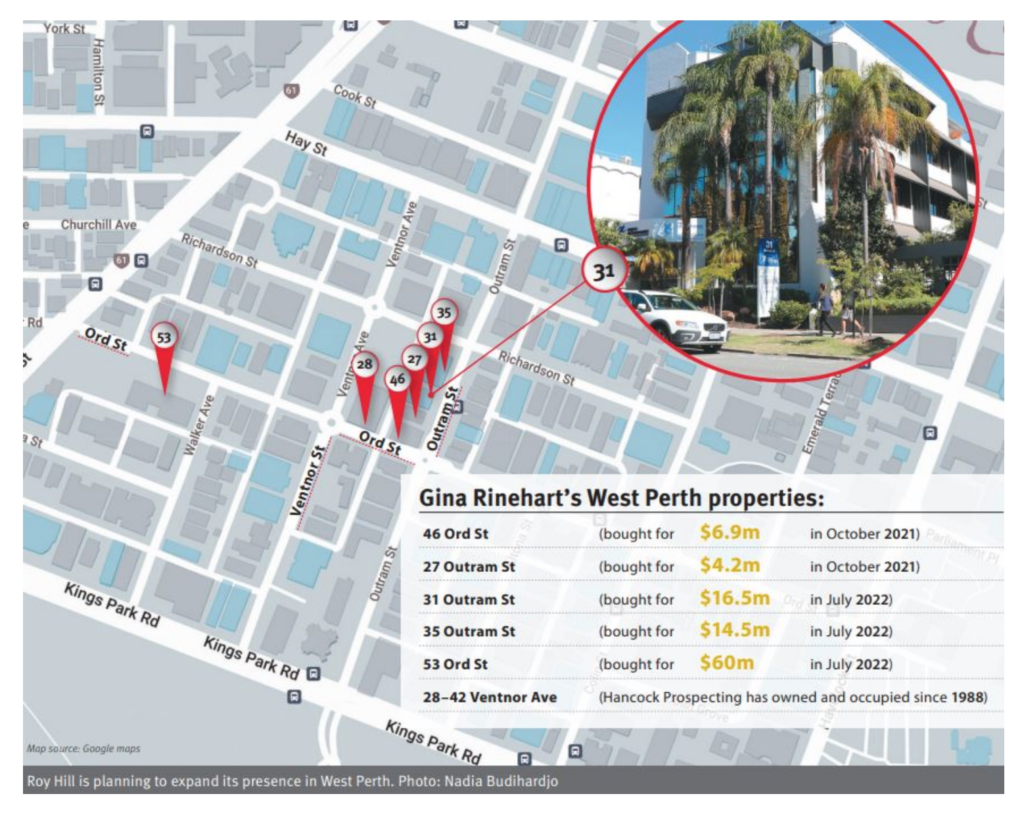

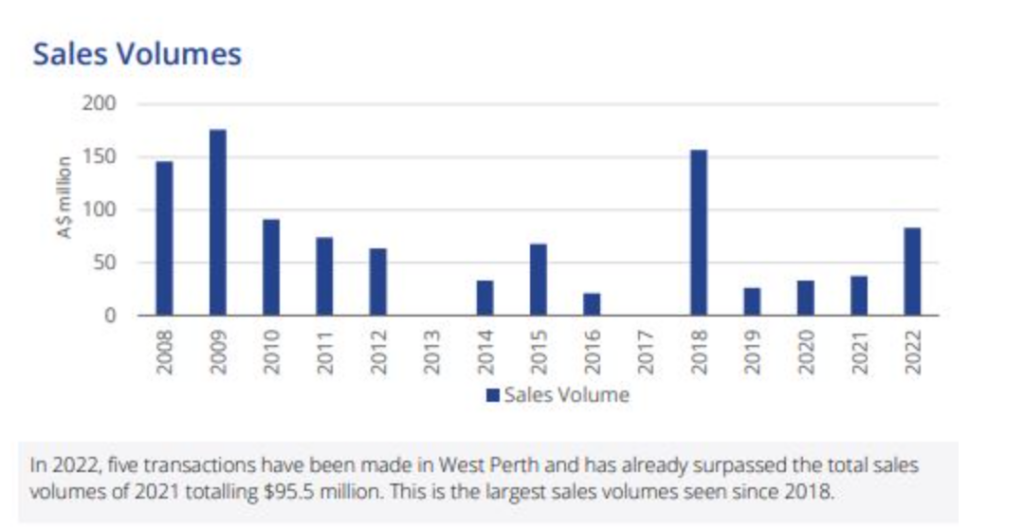

The Hancock Prospecting executive chair owns six office buildings in West Perth, five of which she bought in the past 20 months. Her company’s purchase of 53 Outram Street for $60 million in July last year, believed to be a record price for the area, sparked widespread attention from the property market.

In the same month, entities linked to Mrs Rinehart purchased 31 and 35 Outram Street for $16.5 million and $14.5 million, respectively.

In late 2021, she bought 27 Outram Street and 46 Ord Street for a combined $11.1 million.

Hancock Prospecting ‘s headquarters, known as HPPL House, have been located at 28 to 42 Ventnor Avenue since 1988.

The latest acquisitions give Mrs Rinehart the potential to amalgamate all her West Perth office properties into a 7,189 square metre site, bordered by Ord Street, Ventnor Avenue, Richardson Street and Outram Street.

Mr Bradshaw has recently observed more east coast and Asian investors showing interest in West Perth, drawn by the area’s higher yields relative to other markets in Australia.

Additionally, he said the low supply of quality office stock, opportunities to refurbish and reposition assets, rental growth potential, and the relatively low entry price point for office properties combined to attract buyers to the area.

Colliers research shows the average yields for A-grade office stock in West Perth was at 6.9 per cent in the first quarter of this year, softening from 7.1 per cent in the past 12 months.

This compares to a 7.3 per cent yield for Perth CBD office assets, 5.1 per cent for Sydney, 5.1 per cent for Melbourne, 5.6 per cent for Brisbane and 6.5 per cent in Adelaide.

Leasing

Standing in front of a cautiously optimistic audience at the Property Council of Australia WA Division office market report launch in February, Colliers WA chief executive Richard Cash spoke about West Perth’s diminishing office vacancies.

“The West Perth market [has] had a stellar 12 months,” he said.

“The vacancy rate has dropped significantly, of 15.3 [in July 2022] to 13.2 per cent.” This compares to Perth CBD, with an office vacancy of 15.6 per cent recorded in the Property Council’s latest report.

Historically, West Perth’s five-year office vacancy average is 17.6 per cent and its 10-year average is 15 per cent.

In 2020, the area recorded an office vacancy of above 20 per cent, following the pattern of cities around the globe.

The completion of DFD Rhodes’ new family office at 32 Ord Street has brought 2,867sqm of new supply to West Perth, increasing its office footprint to 416,926sqm.

LJ Hooker Commercial Perth negotiated deals to fully lease the building, with Liontown Resources taking up two floors totalling 1,671sqm and Fogarty Wine Group occupying 1,126sqm.

DFD Rhodes takes up the remaining proportion of 32 Ord Street, which reached practical completion late last year.

Mr Bradshaw said there was high demand for ‘plug-and-play’ office spaces in West Perth, particularly in tenancies between 500 and 1,500sqm.

This is reflected in Centuria Capital Group’s move to undergo a speculative fitout of its 1060 Hay Street property, which it bought for $11.25 million in 1995.

Mr Bradshaw explained that the average tenancy size in West Perth was between 150 and 300sqm, which was less affected by the recent shift to working from home.

Face rents in West Perth have increased by about 5 per cent, while incentives have decreased marginally in recent months.

“This is a result of stronger demand and offsetting higher construction costs for speculative fitouts,” Mr Bradshaw told Business News.

Cygnet West data shows a 5.2 per cent increase in A-grade office rents in West Perth to an average of $380/sqm and a high of $405/sqm in 2022.

The real estate group found a 4.87 per cent increase in B-grade West Perth rents to a $310/sqm average and $340/ sqm high in the same period.

West Perth’s net absorption, a calculation of the difference between the amount of office space that became occupied and space that was vacated, was 8,644sqm for the second half of 2022.

This led to West Perth’s tightening vacancy rate and meant the area’s occupied office space amounted to 316,879sqm, the highest since January 2019. B-grade office vacancy equated to 30,005sqm, or 14.2 per cent of the total B-grade stock, accounting for 54.5 per cent of West Perth’s vacancy total of 55,047sqm.

This presents an issue for landlords working to lease space and reflects the broader gravitation to higher-quality assets across cities generally, agents say.

Cygnet West commercial leasing executive Abbey Agostino said most tenant enquiries were from those seeking to lease fitted space.

“As a result, while the West Perth vacancy rate is still sitting at 13.2 per cent, there is a significant shortage of quality, fitted out space in the market,” she said.

“This is particularly evident in the smaller size tenancies of between 50sqm and 400sqm, which currently accounts for the majority of enquiries, and any turnkey options have the shortest letting time; in one recent example on Hay Street, we leased the fully fitted space before advertising.”

Expansions

Hancock Prospecting is not the only company growing its footprint in West Perth.

According to Colliers associate director office leasing WA, Antonio Trimboli, this was one of the major drivers underpinning increased demand for office space.

“There are a lot of existing tenants in West Perth that are expanding … a lot of mining explorers that are getting to that next phase of growth, and they’re going from say 20 staff to 40 staff,” Mr Trimboli said.

For example, listed land developer Cedar Woods moved to the fourth floor of its building at 50 Colin Street in West Perth as part of its expansion last year, investing in a new fitout as part of the move.

Mr Trimboli added that there had also been new companies move to West Perth, supported by the growth in other mining sectors outside of gold and iron ore.

In addition to new businesses entering the market, some were migrating from the outer suburbs to West Perth, Mr Trimboli added.

Engineering and fabrication company Destrec Contacting, which is establishing a presence in West Perth from Canning Vale, exemplifies this trend.

Meanwhile, Colliers recently completed a deal with construction company Grounded to occupy 550sqm of 11 Harvest Terrace in West Perth over five years, at a gross rent of $460/sqm.

Mr Trimboli said this deal, which stemmed from the landlord increasing rent for the building, reflected the growing demand for the area.

Retail trends

While West Perth’s office market is performing strongly, a shortage of hospitality options has left tenants wanting.

Y Research director Damian Stone said West Perth’s retail vacancy was consistently about 10 to 12 per cent vacant over the past decade.

“The shift to work from home has seen a number of those high-profile ventures like Black Toms [and] Crema Café close in the last twelve to twenty-four months, and while office vacancies have tightened, you haven’t seen a corresponding drop in retail vacancies,” he said.

Lease Equity managing director Jim Tsagalis added that the shortage of workers exacerbated the issue, as hospitality venues struggled to get staff.

Mr Tsagalis said West Perth was undergoing a change in complexion, with several of the major banks deciding to close their branches in the area. His firm last year brokered the sale of former ANZ building 1275 Hay Street for $4.7 million.

A culinary school is now being developed on the site.

A new Woolworths supermarket mooted for 707 Murray Street, as well as a revamp of Watertown’s food court, should help improve food options for the area, industry sources say.