Article by Helen Clarke courtesy of Energy News Bulletin.

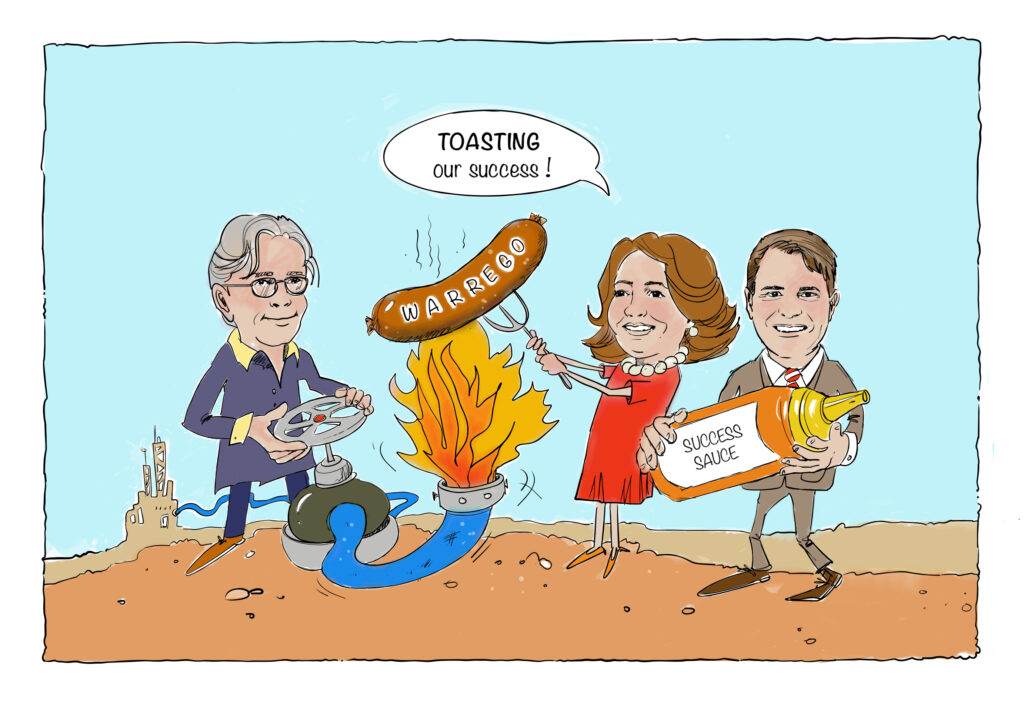

WARREGO Energy has today left the Australian Securities Exchange after its takeover by the private Hancock Energy.

It is the energy division of Hancock Prospecting, the mining giant controlled by Gina Rinehart, which paid 36c per share to Warrego’s shareholders so it could secure 50% of the West Erregulla gas field to send to its mines.

Warrego joined the ASX in 2019 via a reverse takeover deal with the tiny Petrel Energy, whose board members included David Biggs.

Biggs headed up AWE, which held a 50% of the large Waitsia gas field, which was taken over by Mitsui in late 2017 and later joined Warrego as Australian CEO, leaving founder and CEO Dennis Donald to manage the share of two Spanish assets Warrego held.

Biggs later left.

Hancock will share the field with Strike Energy, whose all-scrip takeover offer of Warrego failed but netted the company $136 million cash it will use in a four well drilling campaign and drove its market cap to over $800 million.

As Warrego departs, so ends the most famously fractious joint venture relationship the small end of town saw for some years.