Article courtesy of Mining News Net.

Managing director and chief executive James Champion de Crespigny describes the new Iris Zone, which lies beneath the Boyd’s Dam prospect, as pivotal in the company’s hunt for the extensions at the 22-million-ounce Bendigo Goldfield.

“Bendigo is Australia’s second largest goldfield and we have been looking for the extensions north of it. We have long suspected that we sat above it at Boyd’s Dam,” he said, adding that both zones are equally consistent.

“It is very promising as it is classic Bendigo-style mineralisation and gives us confidence in moving forward. The Iris Zone is contiguous and consistent in nature.”

Catalyst believes this is first proof of its theory that Four Eagles contains the same structural style as the Bendigo Goldfield, where high-grade mineralised zones repeat at depth. The project is on the 75km-long Whitelaw corridor, with the city of Bendigo 70km to the north.

The Iris Zone is close to where the Catalyst-Hancock joint venture plans to develop a 3.6km-long exploration decline. Boyd’s Dam is one of several shallow high-grade discoveries Catalyst hopes can be mined from a single access tunnel, and a maiden resource for it is expected later this quarter.

Diamond drilling continues around Boyd’s Dam, with one RC rig at the Hayanmi prospect to the east.

Looking at the year ahead, Champion de Crespigny said the intention was to add to those resources, which would give confidence in delineating more ounces in the northern Bendigo Goldfield.

Drilling resumed at Four Eagles only late last year after Victoria’s rainfall deluge had concluded. Four Eagles is a JV with Hancock Prospecting, with drilling going to a depth of 150m below Boyd’s Dam.

The mineralisation appears to be part of a continuous zone of mineralisation that strikes for at least 350m and is open to the north and south. Assays on core from the Iris Zone included 5.6m grading 54 grams per tonne, 1m at 150gpt, 1.3m at 77.9gpt, and 5.5m at 10.4gpt.

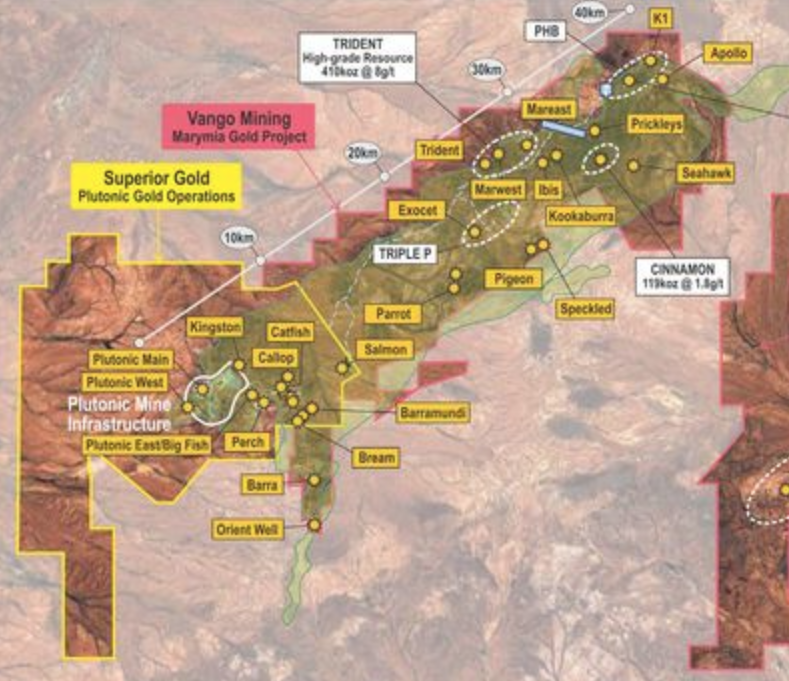

Catalyst has exploration and development projects across the length and breadth of Australia, but the next cab off the rank is its recent acquisition at the Marymia, which lies on the Plutonic gold belt of Western Australia.

Champion de Crespigny says the acquisition at Marymia is “an interesting one” as it holds 500,000oz at 8gpt and ꟷ best of all ꟷ has had next to no exploration since 2000.

“It lies next to several processing plants, and we think, therefore, that is a unique proposition. That entire Marymia-Plutonic belt represents a mineral endowment of more than 14 million ounces of gold. By any measure, that is significant.

“Historically, it has hosted some very attractive deposits, well above a million ounces at 5gpt, for example. We have the Trident deposit on our land package, and that is 410,000oz at 8gpt. We think that will grow as there are attractive intercepts outside those current resources to substantiate that.

“So, really over the course of this year we would look to grow that resource into something quite substantial.”

Tasmania is the Australian state in which the Catalyst is making its production home at Henty gold mine in the island’s north-west.

“At Henty, we have been working hard to bed down that operation – to increase gold production and lower costs. We have been focused on putting in the foundation stones for a quality operation and by that we mean increasing reserves and resources, finalising a proper mine plan and having proper grade control in front of our nose so that we have clarity on the future – and lowering those costs.”

Henty is a high-grade, underground gold-silver deposit with established infrastructure and substantial exploration upside in the mineral rich Mt Read Volcanic Belt, which has historically produced more than 8Moz gold.

Mining at Henty began in 1996 and since then has produced 1.4Moz of gold at an average mined grade of 8.9gpt. Catalyst’s inaugural gold pour occurred in late January 2021 and it is targeting year-one production of 25,000oz on a profitable basis.

“So today it is a very different operation from the one that we bought for $A6 million,” Champion de Crespigny said.

He adds that Tasmania is a wonderful place to operate, with the government and its various departments very supportive.

“As long as you mine in a sustainable and friendly way, the community is very supportive. And the Tasmanian government is very supportive. We have 164 employees there and we think that running a mine like Henty it gives us real credibility to be a proper company operating proper mines across Australia.

“And our step into Western Australia is the start, we hope, of growth in that direction.”

Running production and exploration in tandem, Champion de Crespigny believes Catalyst should grow both organically and inorganically.

“You need to build a company, we think, that is stable enough to weather future challenges. Exploration alone can be a very risky proposition, but if we can build a company that has got stable operating cash flow on good exploration ground, that ensures that we can realise the rising gold price, while surviving the highs and lows of the future with the most stability.”

Talk of the rise of another resources supercycle, similar to the mid-2000s, leaves Champion de Crespigny nonplussed.

“I am not sure whether these supercyles do well for Catalyst or the entire resources industry for that matter.” He points out that one cannot sit around with a focus on commodity prices, with pricing being something which is out completely of the control of miners.

“What we can control is our cost base, and if you can own a better-quality asset, you will tend to produce at well below the price of the commodity. And that is the best way to shore up future success, and it is the best way to realise those price swings.

“Gold and other commodity prices will rise, and it is good to be ready for them when they do, rather than sitting debating when they will or will not.”

To this end, Champion de Crespigny takes a balanced view on the subject of hedging.

“We focus on running a stable and reliable business, we like realising as much of that upside when it comes but sometimes that might involve a prudent amount of hedging. There is no point in putting the future of an entire deposit at risk just to realise the upside.

“So, we believe in running the business as a proper business, rather than perpetually focusing on commodity prices. But, at the same time there’s no point in cutting off the upside; it is important to realise the upside when it comes around,” he said.